If you ask a millennial how they feel about their financial wellness, you’re likely to get a nuanced answer—one that blends hope, anxiety and a healthy dose of realism. The May 2025 survey of Banktastic’s National Millennial Advisory Board offers a look at how millennials rate their own financial wellness, what keeps them up at night and what they wish financial brands would do differently.

This article unpacks the key themes, offers direct quotes from respondents and explores how financial brands can separate themselves from the competition with solutions millennials want.

How millennials rate their financial wellness

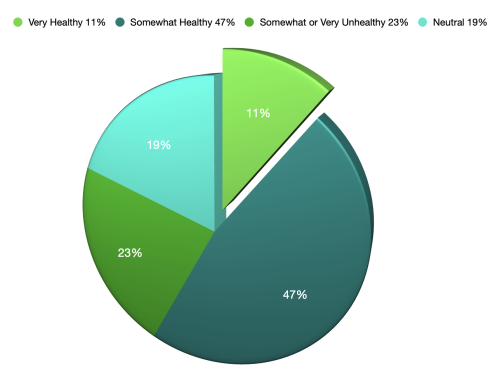

When it comes to self-assessment of current financial wellness, answers are mixed:

- Only about 11% say they’re “very healthy.”

- Nearly half (47%) feel “somewhat healthy.”

- And over 23% report feeling somewhat or very unhealthy.

This means most millennials don’t feel they’ve “made it” yet, but many are at least cautiously optimistic that they’re on the right track.

How millennials rate their financial wellness.

How millennials rate their financial wellness.

Top metrics and habits: how millennials track their progress

Millennials are hands-on with their finances:

- The most closely tracked metric? Checking/savings account balance (50%), followed by credit score (13%) and net worth (10%).

- Many check their main metric weekly (47%) or even daily (26%).

- Most use multiple measures, including cash flow, debt and retirement savings to track how they’re doing.

How millennials define financial wellness: in degrees of anxiety

The open-ended responses show that financial wellness is about more than just numbers; it’s about how their finances impact their stress and anxiety levels.

- “Not being worried about money” and “not living paycheck to paycheck” came up repeatedly.

- Having an emergency fund, little or no debt and the ability to weather unexpected expenses is another commonly mentioned theme.

- Knowing where money is going, having a plan and feeling empowered to make good decisions were also recurring themes.

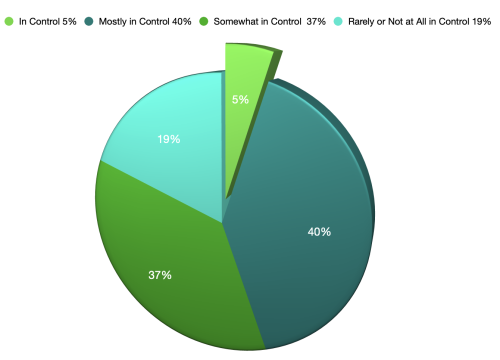

Millennials feeling control of their financial wellness.

Millennials feeling control of their financial wellness.

In their words:

“I think it would mean just not having anxiety every day and/or related to every single purchase—not having financial concerns being top of mind and the primary driver of decisions.”

“Not thinking twice about adding guacamole at Chipotle. Being able to afford going out to eat.”

“The ability to afford medical appointments on time.”

“Financial wellness means I can sleep at night without stress or anxiety around money. That I know I could withstand a major life event, such as illness or job loss, without it causing major financial disruption.”

“Financial wellness means having reliable income that meets your needs and having your money set up to succeed.”

“Never having to ask money for permission to do what I want.”

Barriers to financial security: what’s standing in the way

Only 5% report feeling completely in control of their financial future, but 40% say they feel mostly in control.

That leaves 56% feeling somewhat, rarely or not at all in control.

The biggest millennial roadblocks to financial wellness are not surprising. Stagnant salaries combined with rising costs of living are a burden. They find it hard to save or invest while managing credit card or student debt.

Economic and job uncertainty also play a role: “Job security,” “the current economy” and “uncertainty about the future” are recurring themes in their feedback.

In their words:

“It just seems like there’s always something that keeps us from getting ahead.”

“I don’t make enough money to save much if anything and anytime I do get some savings built up I have an unexpected expense.”

“Life feels like a never-ending game of struggling to get out of debt so I can enter the next phase of life which immediately plunges me back into debt... and then repeat.”

“Childcare + insanity of the economy.”

Looking ahead: hopes, worries and regrets

Most millennials hope to be closer to their financial ideal by 2030, but there’s a clear presence of anxiety about the economy, politics and the unpredictability of life.

“In the current economic environment, it seems to be very difficult to feel financially secure, I would suspect even for wealthy folks who have a sizable portion of their net worth in investments. The unknown of what is going to transpire and where our country will go over the next four years is extremely anxiety inducing.”

“…immense debt from wedding; previously was immense debt from college/grad school. Life feels like a never-ending game of struggling to get out of debt so I can enter the next phase of life which immediately plunges me back into debt ... and then repeat.”

What banks and credit unions can do to help millennials feel reassured and confident

Millennials are telling us what they need—loud and clear. Besides financial education, (which is a well-known need), here are other ways financial institutions must step up:

- Make saving and investing easier—Fintechs and neobanks do this very well. It’s time for banks and credit unions to get in the game. Streamline the process for building emergency funds, investing for retirement and automating savings—even in small amounts.

- Address debt head-on—Provide solutions for managing, consolidating or refinancing debt. Offer guidance that’s empathetic, not judgmental. Millennials often relate feeling fearful about being judged. Make it clear that many smart people just like them are in the same boat. Help remove the stigma (implied or real) they dread.

- Advocate for financial well-being—Go beyond products. Support policies and initiatives that address the root causes of financial insecurity, like affordable housing, childcare and student loan reform. Demonstrating your engagement with these issues can separate your brand from others who are still simply offering the same run of the mill sponsorships and free shred events that have become ubiquitous.

- Innovate for stability—Products that help smooth income volatility, protect against job loss or offer affordable insurance can make a real difference.

In their words:

“Honestly it's probably just making some smarter decisions. It's knowing when to be risky and when to be frugal. Having more income is a goal that I think I always have so I do a lot of side gigs and things, but presumably if I could raise my income to a certain level, my financial security would be stronger. But, I also think that I could be making smarter investing decisions at least ones that are maybe more efficient.”

Millennials are calling–will you answer?

Millennials aren’t just looking for higher balances—they want peace of mind, control and a sense that their financial future is in their own hands. Brands that listen, empathize and innovate will not only win their business but also their trust.

“Financial stress is a really heavy weight in my life currently.”

“Cash flow is key.”

“Cost of living is out of control and certain to get worse.”

The message is clear: Millennials want to feel secure, empowered, and understood. To be relevant to this important generation, banks and credit unions must move past the old ways of conducting business and answer the call.

Get custom research with millennials for your bank, credit union or advisory firm—now including Quick Pulse for fast answers. Book a meeting with Martha Bartlett Piland, CFMP to talk about what you want to learn.

This article was reposted with permission by the American Bankers Association ABA Journal.

photo credit: Farhat Altaf on Unsplash