It’s no surprise that Gen Z, the generation born between 1997 and 2012, has a different vision than previous generations for banks serving them now and into the future. In a recent shadow day for college students, we asked six seniors from six different universities to create a bank brand that spoke to them—then detail its offerings.

Here's a rundown of the input from this small sampling of a tech-savvy and socially conscious generation—and some takeaways for every bank planning its future success.

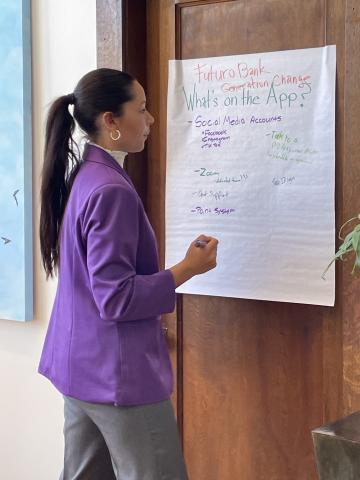

Futuro Bank: A Visionary Brand

One standout concept was the students’ creation of "Futuro Bank" with the slogan “Generation change.” This branding reflects a forward-looking approach, signaling a shift toward innovation and adaptability in the banking sector, as well as a reflection on this generation’s power and desire to create change in the world.

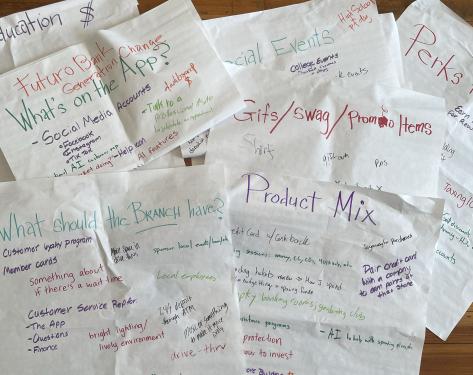

Tailored product mix

Our Gen Z students expressed a clear desire for a product mix that aligns with their lifestyle and values. This includes offerings such as credit cards with cash back incentives, flexible spending accounts, layaway options for purchases and partnerships with companies for earning points at favorite stores.

Customer perks galore

The students emphasized the importance of perks tailored to Gen Z customers. And they had a long list! These include point and rewards systems as well as assistance in building credit.

They also value expedited services, such as the opportunity to skip the line in-person or at a drive-through.

They asked to be rewarded for app usage or branch visits via a point system and perks for doing so.

Bankers will not be surprised that they asked for discounts for college students and recent graduates.

Community-centric special events

Gen Z values community engagement. This group suggested cashback events, fundraisers for local teams and nonprofits and customer appreciation days.

They also proposed educational seminars and small business support initiatives to empower their communities.

Empowering financial education

Not unlike millennial needs, education emerged as a top priority, with Gen Z seeking AI-driven spending assistance, budgeting tools and fraud protection. They also emphasized the importance of training sessions on topics like using credit cards, investing and small business startup and management.

Digital innovation: the app experience

The students envisioned a cutting-edge app experience, including daily login bonuses, customizable features, and direct access to bankers for financial advice or help with their accounts—including outside of standard business hours.

They also want market analysis tools, spending habit reviews and clear dashboards to visualize their finances.

Multi-language support and digital interface was mentioned several times in this group.

Revamping branch facilities to create welcoming spaces

While digital services are paramount, the students still placed some value on physical branches. They recommended improvements such as wait time notifications, enhanced drive-through experiences and access to top tier management.

They suggested freebies like coffee, donuts and dog treats to create a welcoming atmosphere in the branch. They also talked about lighting and music to create energy and interest in the space.

Internship opportunities for college students were also proposed to foster talent development. The students generated a pile of ideas.

The students generated a pile of ideas.

Additionally, access to meeting rooms for clubs and groups was appealing to these students.

How bankers can address Gen Z needs

Be better at making audiences aware of your products and services

Many financial institutions already offer a number of these products and services the students mentioned. So it is important to make sure their Gen Z audiences are aware of these offerings and how to access them.

Sharing information through social media, the bank app and website and in advertising will help students know what you have to offer and how it benefits them.

Test and add some perks just for Gen Z

Consider testing some of the proposed perks with existing Gen Z customers to see what resonates. Some of these ideas like skipping the line could be simple and nearly free to implement.

And others, like help with credit building, can be a valuable service to customers that also generates income. Regions Bank recently introduced such a product. Read about it here.

Continue investing in the digital experience

There’s no escaping the need for continuous improvement of your digital experience for customers. Incorporate gamification, be data-savvy to customize the people interactions and move toward offering language choices. It can’t be done overnight, but it will be essential to get there.

Create a Gen Z advisory board

Have ongoing communications with this cohort of customers to test your assumptions, find out what they really value and plan for the future.

Preparing and adapting for Gen Z's expectations

This small group of Gen Z students offered their vision for the fictional Futuro Bank–or your bank—with actionable insights.

They want a bank that feels approachable, integrates with their tech-driven lives and offers genuine support for their financial goals. Providing personalized experiences with access to experts and community engagement is crucial. And so is digital convenience.

Like other generations, they want it all.

By embracing innovation and being agile, banks can build lasting relationships with up-and-coming customers and thrive in an ever-evolving financial space. Our small group’s vision of Futuro Bank reflects not just a change in banking services but a transformation in how banks connect with the next generation of customers.

For more insights from Gen Z about their career and what they want from employers, read our blog: Employers looking for fresh grads: here are some things Gen Z hopes you'll offer.

If you need help from a bank marketing agency to help you reach Gen Z, let's talk. Contact Martha Bartlett Piland at 785-969-6203 or by

photo credit: change sign by Claudio Schwarz on Unsplash